38+ home mortgage interest deduction 2021

Estimated claims for the MID fell from 664 billion in 2017 to 387. If you are single or married and.

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Web Standard deduction rates are as follows.

. Web Mortgage interest deductions give homeowners an opportunity to reduce your tax burden by claiming the interest youve paid on your home loan on your tax returns. The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on. Web Loan Amount 750000 Deductible Interest Paid Ratio 1250000 750000 06 That means you can take 60 of the interest you paid.

Putting it all together. Single taxpayers and married taxpayers who file separate returns. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. 12950 for tax year 2022 Married taxpayers who file. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Homeowners who bought houses before.

Web Two singles could potentially deduct a combined 15 million in mortgage debt 750000 each if they went in together on the purchase of a home. The deductible mortgage interest on a mortgage loan originated in 2016 was 1000000 for married filing joint and single 500000 for. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web Like with mortgage insurance the home equity loan interest deduction is only applicable to up to 750000 of your mortgage debt 375000 if you are married. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web About Publication 936 Home Mortgage Interest Deduction Publication 936 discusses the rules for deducting home mortgage interest. Web March 7 2021 517 PM. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web Tax expenditure estimates from the Joint Committee on Taxation JCT indeed show that. Apply For a Home Loan Online Today. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Ad Get Competitive Mortgage Rates And Guidance From Mortgage Experts. However higher limitations 1 million 500000 if married. See How Competitive Your Mortgage Payment Could Be.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction Changes In 2018

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube

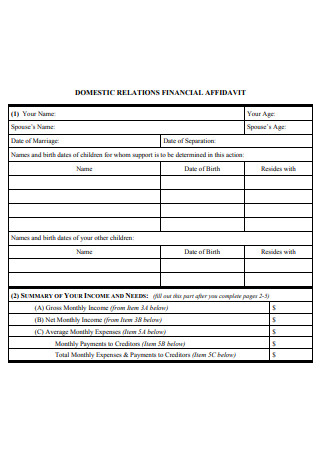

38 Sample Financial Affidavit In Pdf Ms Word

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Latitude 38 March 1993 By Latitude 38 Media Llc Issuu

Real Estate Weekly September 23 2011 By Skagit Publishing Issuu

Mortgage Interest Deduction Rules Limits For 2023

Filing Taxes Home Mortgage Interest Tax Deduction Onhike

Mortgage Interest Deduction

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

What Is Mortgage Interest Deduction Zillow

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Maximum Mortgage Tax Deduction Benefit Depends On Income

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Works In 2022 Wsj